Warning

This article and series is specifically targeted for anyone involved or interested in oil and gas reserves reporting guidelines, methods, issues, calculations and pitfalls. Proceed at your own risk!

Introduction

Reserve reports typically present the lifetime oil and gas reserves and expected cash flows for a commercial entity that has ownership in a specific set of properties. The report could involve only one well, or possibly tens of thousands of wells spread out in numerous productive basins targeting different reservoirs and involving various operators. Any proper reserve report should describe the entity, the purpose for the report and detail any complexities so the reader can be fully informed. Most importantly, summary cash flow tables are the “main event” of the reserve report effort, where reserves and values are shown in one very detailed page. It should be pointed out, however, that reserves and cash flows shown in reserve reports DO NOT take into account interest payments, debt service or federal income taxes unless specifically noted. Herein, we will take a brief tour of a reserves-based cash flow page and explain some of its nuances, leave you with an explanatory reference guide, and throw in a bonus rate-versus-time graph to drive home how forecasted production is converted to dollars and discounted cash flow.

Production Rate vs Time Graph (Semilog)

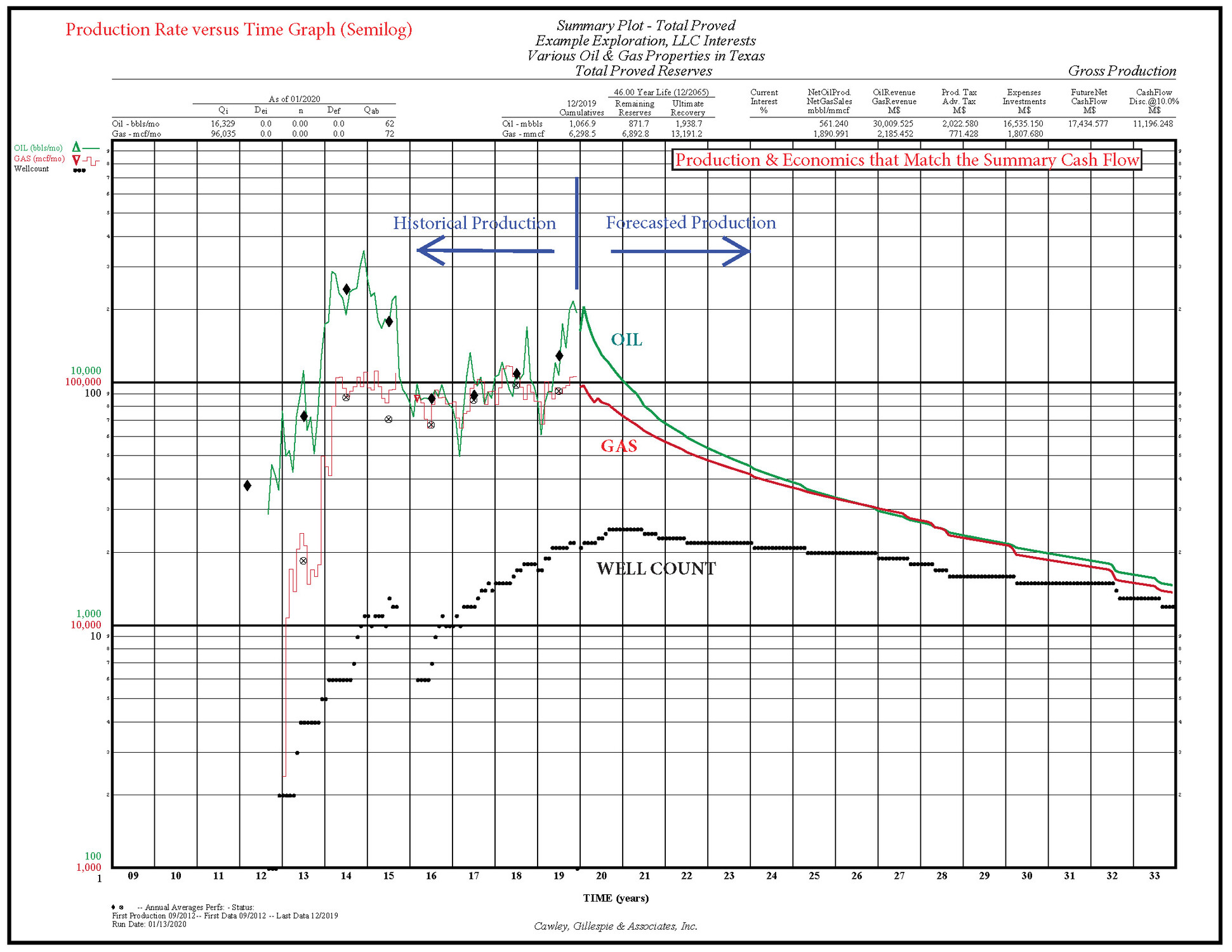

Reserve reports will often present graphical “rate versus time” figures to show a visual representation of historical and forecasted oil and gas production. In Figure 3 below, we have included a Summary Plot that is related to the Total Proved summary reserves and economics statement in Figure 1. In this case, GROSS historical oil/gas production and well count are shown prior to the December 31, 2019 effective date, and GROSS forecasted values are shown after this date. In addition, our plots include summary production, reserves and economics values at top right that match the cash flow page.

Note that this graph shows logarithmic rate versus linear time (semilog), which is very common in the energy industry due to the declining production behavior of oil and gas wells. In fact, for this particular evaluation individual well rate versus time plots were utilized for decline curve analysis (DCA) to forecast future production. These individual forecasts were rolled up into this Total Proved composite rate versus time plot, which actually is made up of 24 producing wells (PDP), 3 behind-pipe wells (PDNP) and one drill (PUD). These details would have been revealed in a full reserve report, but you can still glean a significant amount of detail from just a summary cash flow page and summary rate-time plot.

Closing

This was a brief tour of the most important page in a reserve report… summary cash flow for proved reserves. The rest of the reserve report (report letter, table of contents, individual well analysis, reserve definitions, etc) all serve to support the summary cash flow. But, be aware that reserve reports can be very complex and do not always show every detail that went into the valuation. We encourage you to read the report letter in full so you can understand the reason for the valuation and assumptions applied to prepare cash flows and determine value. We can help you with that, so feel free to reach out here or contact a CG&A professional at the links below. Thanks for reading!

Contact CG&A about Reserves: reserves@cgaus.com

Check Out Our Website: www.cgaus.com

Special thanks to @Jeffrey Wilson PE, @Jonathan Schmit, PE and @Shelby Loskorn for their efforts in publishing this series.